Another Set of Shoes: Life Over 100K

"Another Set of Shoes" highlights the diversity of life, empowering those featured to be who and what they are. Nothing more and nothing less. In the process, we hope to see past the stereotypes that are so deeply ingrained in modern culture and to illuminate the complexity of the human experience.

Last month, we met Sandra who found herself constantly chasing the poverty line. This week we step into the shoes of Nicole, a mom in New York City who makes $115,000 a year, putting her family in the top 22% of households in the nation according to federal census data from March 2016.

It’s 1:00 AM and Nicole has been working for the past four hours. A whimper comes from the living room: “Mama?” She prays he’ll fall back asleep, but the cries get louder, the sleep draining from the edges of her son’s voice. As she rolls out of bed, another set of footsteps drag from the small kitchen to the tatami mat on the living room floor that serves as her toddler’s bed. Her husband is still awake; she pulls the covers over her head and hopes for sleep.

As she drifts off, she remembers that first year, before they figured out how to work together as parents. She was always career-driven, and he had mentioned he wanted to be a stay-at-home dad, like her dad had been. When the baby came, that plan changed. He was consumed by his work and didn’t naturally take to parenting. She struggled to exclusively breastfeed while running her fledgling company from home.

At first, she handled the workload with confidence. She’d take conference calls while gently bouncing her infant, praying he’d stay silent. When a major deal was on the verge of closing, she got on a last-minute flight to Vegas with a month-old baby, quickly handing him to a coworker as she entered the meeting. When she walked out, she hoped no one had noticed the tiny wet spot where her breast milk had leaked through her shirt.

Both working, their joint bank account rose, but crossing the $100,000/year threshold didn’t create more time, and the lack of balance damaged their marriage.

Since then, they’ve (sort of) figured things out. She weaned the little one, and they signed him up for full-time childcare once he was a year old. Her husband gradually started taking on parenting tasks without having to be prompted. The load was slowly equalizing.

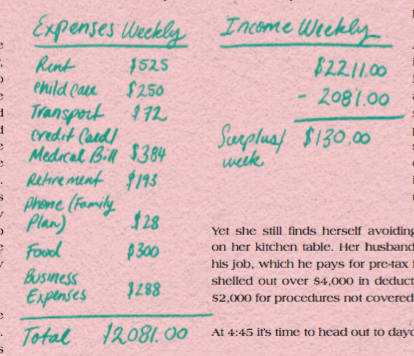

She reminds herself of this when she wakes up at 7:30 in the morning, after the 1:00 AM bedtime, to get her son ready for daycare. She dresses him, microwaves a packet of instant oatmeal, and herds him out of the apartment. When they get to daycare, Nicole hands over $250 for the week, the absolute maximum she can afford to pay. Kids just a little further downtown are already reciting their ABCs and 123s, but she’s accepted the fact that this is a bare-bones operation, which is the most you can ask of a $250/week facility in NYC. She knows because she’s visited them all.

In warmer weather, she’d use the trip home from daycare as a way to squeeze in a jog, but, with snow on the ground, the best she can do is to trudge along. Like painting and reading, running has become another passion that’s dropped off of her calendar due to scheduling constraints.

Back at the apartment, her husband is at his computer with headphones in. Last January, Nicole stepped down from her company to start another, and her husband stepped in to fill her role. Between that and gigs, he works a 60-80 hour week.

She sends emails to podcasts asking to be featured as a guest, packages products for shipping, writes a few articles to promote her new company, replies to comments on social media, and takes a 20-minute break to shove salad in her mouth while picking up toys.

As a girl who grew up in a blue-collar town in the Midwest, she’s sometimes alarmed by her financial success. She lives in perpetual fear that the stream will dry up, which causes her to hoard pennies in IRAs, CDs, and long-term, ultra-safe investments.

Yet she still finds herself avoiding the stack of medical bills on her kitchen table. Her husband gets health insurance with his job, which he pays for pre-tax from his paycheck, but they shelled out over $4,000 in deductibles this year, and another $2,000 for procedures not covered by their plan.

At 4:45 it’s time to head out to daycare pickup.

She tries to read up on potty training tips while working her way through the slushy streets. Her cloth diaper stash has been worn thin. It’s time for him to start using the toilet, or she’s going to be stuck shelling out cash for disposables. The “potty training in three days” method sounds perfect, but when would the family find time to stay indoors for three consecutive days?

After getting home, they order a mostly-nutritious meal for $32. It would be cheaper to cook, but shopping, cooking, and cleaning dishes would require carving out time, most likely from sleep, something she hasn’t had enough of in years.

After dinner, she brushes her teeth with her son and notices the near-empty hand soap. Add a little water, and there’s just enough to make it work for another day or two. She makes a mental note to place an order as soon as he’s in bed.

While running through her to-do list, she calls for her husband. Together, they read one of the books stacked in a corner and she tries to remind herself to buy an alphabet book next time she’s at the store. After a kiss goodnight, she slips off to the bedroom where she checks her phone for messages. Her son falls into a steady slumber, her husband’s footsteps head back towards the kitchen, and she opens her laptop.

Background, Context & Reference

More From This Issue

Rock Your Bliss: Less Beat the Clock, More Meet the Clock by Jacki Carr

The Art of Looking Slowly by Bethany C. Gotschall

Fast Burners, Slow Burners by Kristin Stangl

Review: The Uncommon Type by Karstee Davis

by Karstee Davis

Kids Come Too: Costa Rica by Fiona Tapp

Befriending Boredom by Sandi Schwartz

View All